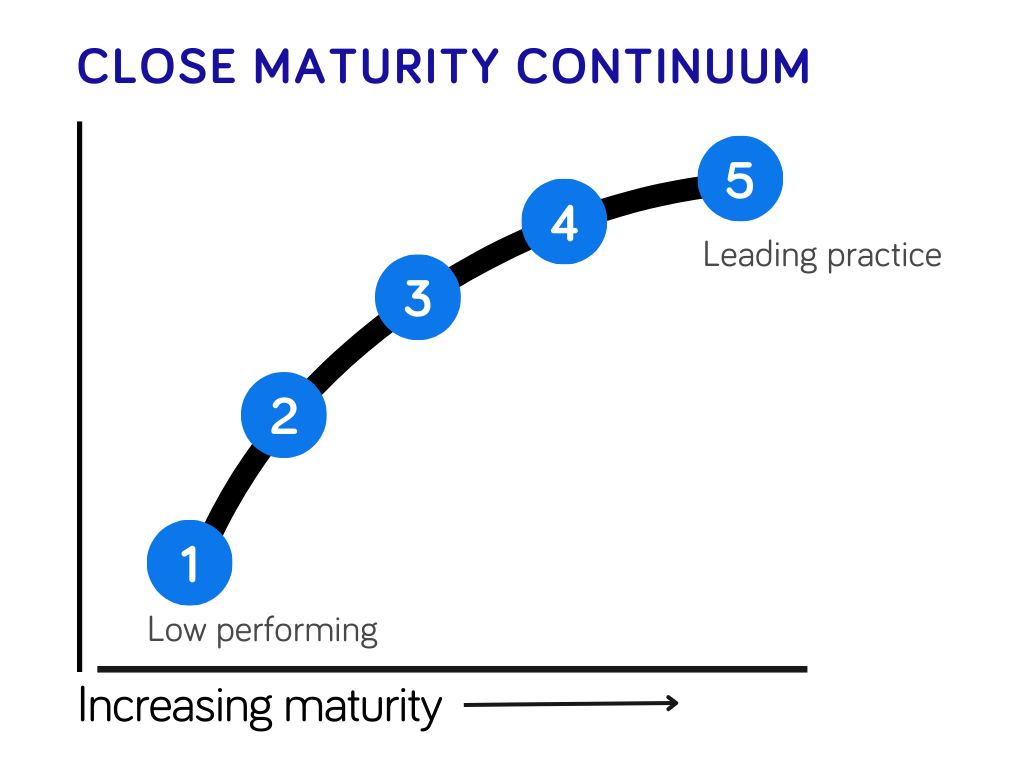

The close maturity continuum: Leveling up your performance

Understanding where you stand on the close maturity continuum can help size the gap in your performance level—where you are and where you could be.

Symptoms of a low-performing close process

The more of these you relate to, the further you are from leading practice.

- It takes you more than 5 workdays to close and generate financials

- Your earnings release takes over 30 workdays to produce

- Trial balance resubmissions and late cycle adjustments are common (and you find yourself saying, “The numbers keep moving…”)

- You struggle to pinpoint who has the right numbers

- Finger-pointing across groups often takes place (e.g., Corp and SSC)

- You face frustration from downstream customers including FP&A, tax, and investor relations

- Your business stakeholders don’t understand financial results and question reliability

- You find that it is difficult to bridge results in various reporting methods (US GAAP, local statutory, and management reporting, for example)

- It’s difficult to accommodate business changes (M&A, new regulations) without major process disruption

- You spend substantial amounts of time on immaterial transactions or variances

- Theres a lack of visibility into process performance—things like KPIs, cycle times, error rates, and bottlenecks

- Your team is showing career dissatisfaction and your turnover rates are high

What great looks like

With leading practice processes in place, you’ll have higher visibility, less manual labor, and more time to make forward-looking decisions. Here are some examples:

- Generating financials is easy—final results are available shortly after month-end on workday 3-5

- You have high percentile rankings on benchmark metrics for cost, cycle time, and defects

- Audits run smooth and have limited findings

- Collaboration is strong with clear roles and responsibilities across teams (Corporate, shared services centers, local, etc.)

- You spend most of your time processing or analyzing—instead of gathering your data

- You are resilient and able to quickly adapt to accommodate business changes, from mergers and acquisitions to new regulations

- You spend less time on low-value activities like data mapping, data cleansing, adjusting journals, duplicate reports—and more time on what matters

- You have governance mechanisms in place that drive accountability, monitor performance, and reward continuous improvement

If you’d like to learn more about a leading practice close process, explore the key financial close KPIs.